By Tee Lip Hwe, Senior Librarian, Research & Data Services

ESG research deepens our understanding of the impact of environmental, social, and governance factors on business performance and sustainability. With an increasing focus on sustainability and responsible business practices, organisations and researchers alike are exploring the implications of ESG factors in greater depth.

In this edition of SMU Libraries ResearchRadar, we take an initial look at the transition effort towards Net Zero and explore some useful functions and formulas for discovering and gathering ESG data in Bloomberg. Additionally, we introduce a new environmental dataset, ‘The Environmental Suite by WRDS’.

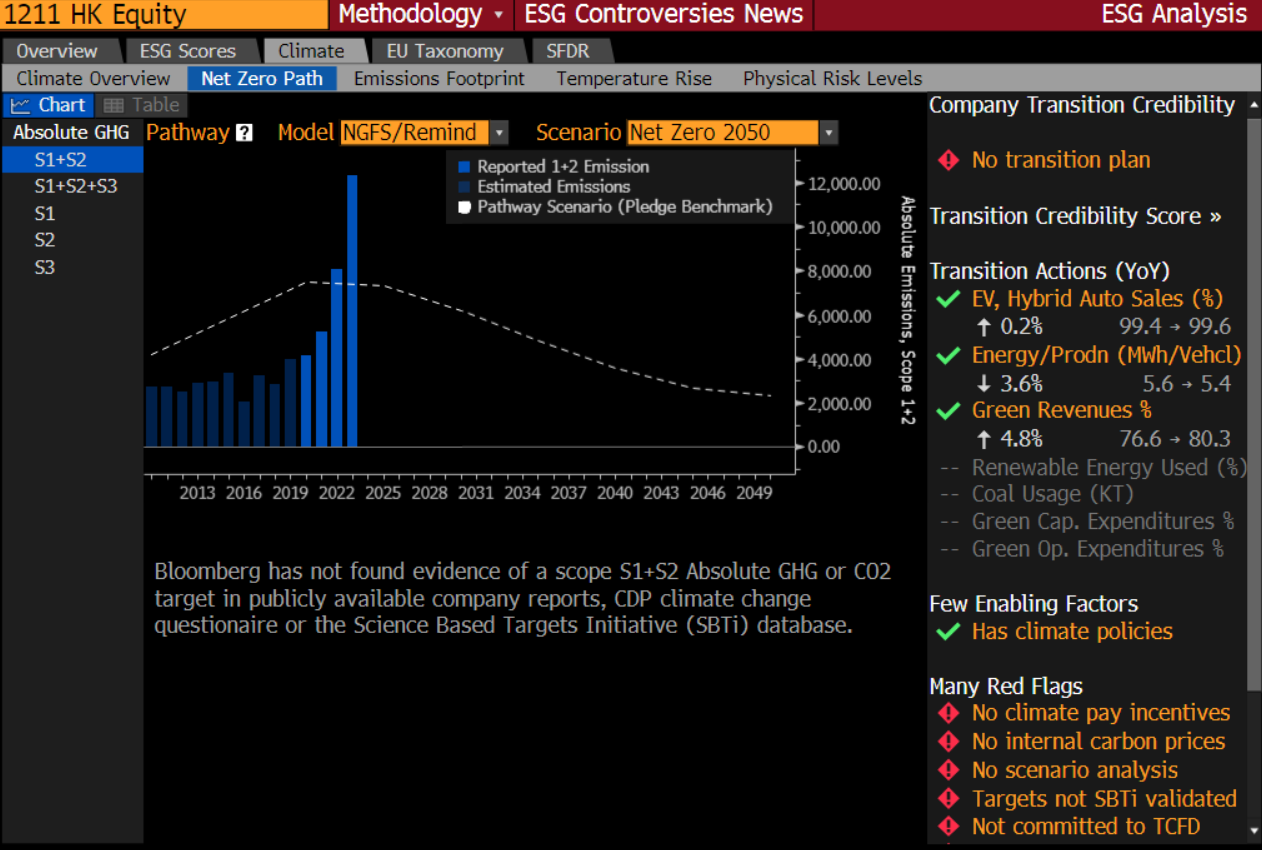

ESG Analysis: Net Zero Path

ESG NETZ <GO>

One of the key tools available on Bloomberg for assessing a company's emissions reduction efforts is the ESG NETZ <GO> function. This function provides a detailed analysis of a company’s path to achieving Net Zero emissions. Its feature includes a new streamlined Transition Credibility indicator panel, which:

- summarises the transition actions driving progress toward Net Zero, and

- analyses the credibility of these transition strategies, providing valuable insight into a company’s commitment to reducing its carbon footprint.

Green Revenue %

One critical metric often used to measure sustainability efforts is the percentage of revenue derived from green activities. For instance, ‘Green Revenue %’ can be calculated.

The following steps reproduce the proportional change in percentage, i.e. ‘Green Revenue %’ as shown in Fig. 1, for BYD for the fiscal year of 2023.

- Use Bloomberg Data Point (BDP) formula to extract the estimated percentage of total revenue generated by BYD that complies with the relevant European Union (EU) Taxonomy technical screening criteria for substantial contribution, for fiscal years 2023 and 2022:

YR2: =BDP("1211 HK Equity", "EU_TAX_EST_SC_REV_PCT", "EQY_FUND_YEAR=2023") YR1: =BDP("1211 HK Equity", "EU_TAX_EST_SC_REV_PCT", "EQY_FUND_YEAR=2022") - Calculate proportional change in percentage:

[(YR2 – YR1) / YR1] × 100 = [(80.3 – 76.6) / 76.6] × 100 = 4.8%

Note: This Transition Action (YoY) item ‘Green Revenue %’ is hence the waterfall of EU_TAX_EST_SC_REV_PCT

This indicates that BYD's ‘Green Revenue %’ increased by 4.8% year-over-year. The ‘Green Revenue %’ metric, based on the EU_TAX_EST_SC_REV_PCT, is a key component in understanding how much of the company's revenue comes from sustainable sources. It's worth noting that the EU Taxonomy is a classification system that defines criteria for economic activities aligned with a net zero trajectory by 2050, making it a critical tool for sustainability reporting.

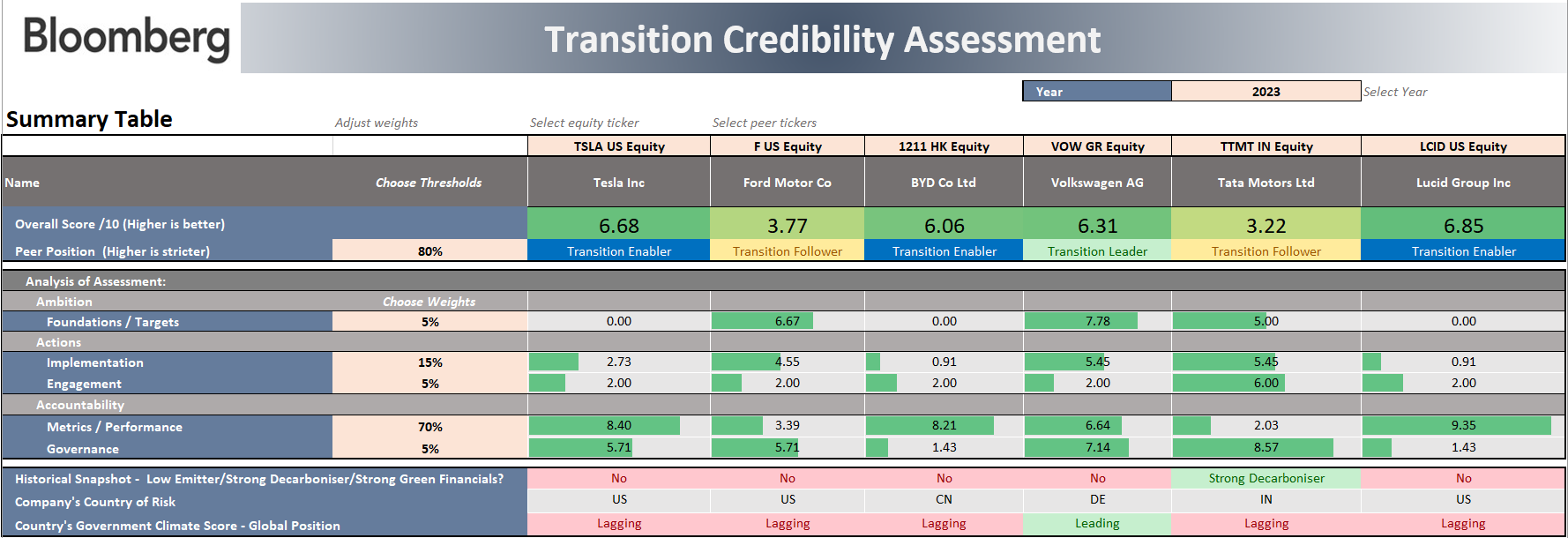

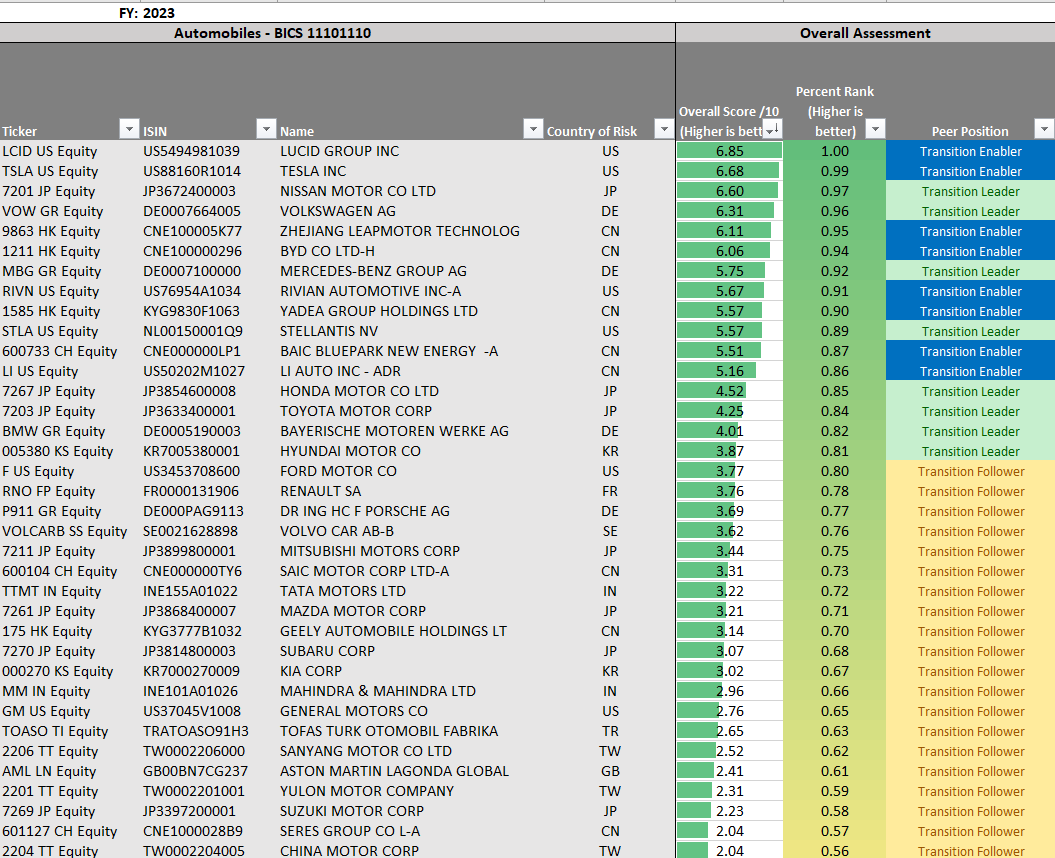

Transition Credibility Score

In addition to revenue-based metrics, Bloomberg offers new Transition Credibility Score, particularly useful for high-emitting sectors such as the automobile industry. These scores identify a company's decarbonisation actions compared to its peers, providing a relative assessment of how credible their transition plans are.

In summary, the Transition Credibility indicator panel is a valuable tool that reveals a company's progress in its decarbonisation efforts/climate goals.

Finding ESG Data Items in Bloomberg

Field Search FLDS <GO>

As we expand our exploration beyond transition credibility, Bloomberg users have access to valuable tools for finding ESG data.

To look for ESG data items, Bloomberg users can use the Data Field Finder FLDS <GO> function.

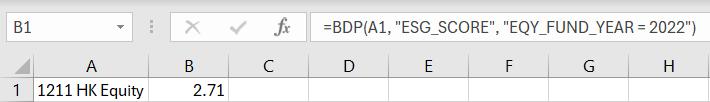

The following BDP formula extracts Bloomberg ESG Score ‘BESG ESG Score’ for BYD for the fiscal year 2022. This aggregated ESG metric has a value range of 0 to 10, with 10 being the best.

=BDP("1211 HK Equity", "ESG_SCORE", "EQY_FUND_YEAR = 2022") or

=BDP("1211 HK Equity", "ESG_SCORE", "EQY_FUND_YEAR", "2022")

Accordingly, to cell reference fiscal year at Cell K1, one can use

=BDP(A1, "ESG_SCORE", "EQY_FUND_YEAR", K1)

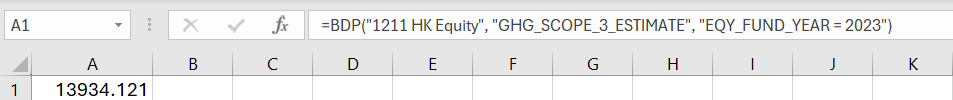

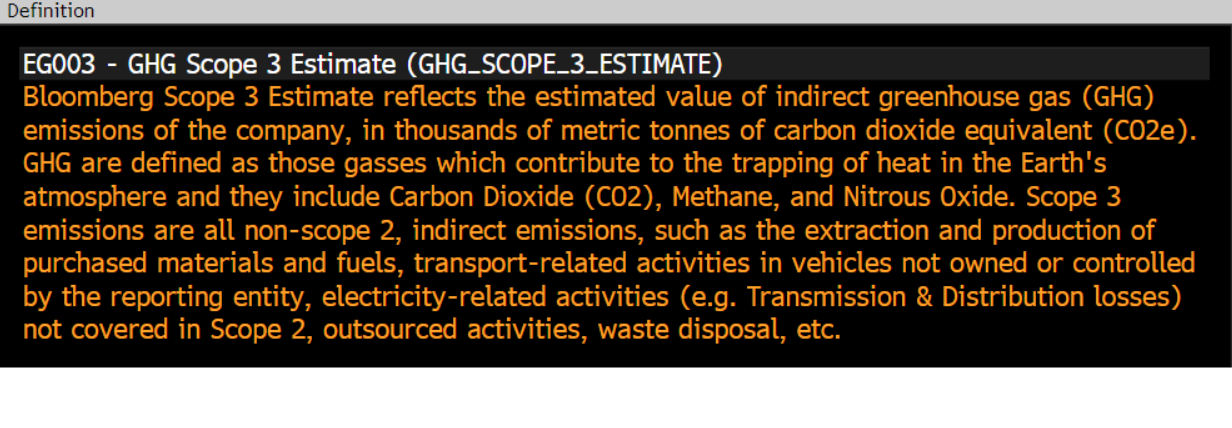

Here is another example, i.e. to extract the Scope 3 indirect greenhouse gas (GHG) emissions estimated by Bloomberg of BYD for the fiscal year 2023.

=BDP("1211 HK Equity", "GHG_SCOPE_3_ESTIMATE", "EQY_FUND_YEAR = 2023")

The concentration of CO2 acts as the Earth's thermostat. Currently, carbon dioxide constitutes approximately 421 parts per million (ppm) of the atmosphere, beyond the safe level. See Bloomberg Carbon Clock for a real-time estimate of the monthly CO2 concentration.

ESG Discovery ESGD <GO>

Bloomberg's ESGD <GO> function serves as the ESG data dictionary.

As shown in Fig. 8, there are 572 ESG data items relevant to the Corporate Sustainability Reporting Directive (CSRD) framework.

Here is an example of extracting a climate pay incentive ESG marker/indicator, namely ‘Executive Compensation Linked to Climate’, available under the CSRD framework, for BYD for the fiscal year 2022.

=BDP("1211 HK Equity", "EXCTVE_COMPNSTN_LINKD_CLIMTE", "EQY_FUND_YEAR", "2022")

By leveraging these tools, Bloomberg users gain access to a broad array of ESG data and clearer understanding of what each metric signifies. This integrated approach enhances the ability to make informed choices for comprehensive ESG analysis.

In conclusion, the Bloomberg Terminal is a rich resource for gathering ESG data and insights. For a comprehensive overview of Bloomberg ESG ecosystem, explore the BESG <GO> function.

What’s Next

In addition to Bloomberg, a new dataset is available—The Environmental Suite by WRDS—which brings environmental data from the US Environmental Protection Agency (EPA) into the Wharton Research Data Services (WRDS) platform.

Launched by WRDS in mid-2024, the Suite is a specialised data resource that tracks pollutants. Focusing on environmental compliance, it reports on EPA data, covering inspections, violations, and enforcement actions. With panels on Air, Water, Facilities, and Geography, the Environmental Suite enables multi-dimensional environmental analysis.

This dataset will be particularly useful for research across various fields, including climate studies, economics, health, and policy design. For more, visit The Environmental Suite by WRDS.

Begin your ESG journey by booking a Bloomberg Terminal today and start exploring The Environmental Suite by WRDS from September 2024.

For further assistance, please email Tee Lip Hwe at lhtee@smu.edu.sg.

References

Bloomberg L.P. (2024). Bloomberg Terminal.

European Commission. (n.d.). EU taxonomy for sustainable activities. Retrieved September 15, 2024, from https://finance.ec.europa.eu/sustainable-finance/tools-and-standards/eu-taxonomy-sustainable-activities_en

Wharton Research Data Services. (2024). The Environmental Suite by WRDS. University of Pennsylvania. https://wrds-www.wharton.upenn.edu/pages/data-announcements/the-environmental-suite-by-wrds/